Jon Rahm rode eight birdies to the top of the leaderboard at 8 under at LIV United Kingdom on Friday, surging to the front of the pack after Bubba Watson tumbled through consecutive par-4s in 12 shots.

Looking for ‘solutions’, NBC tweaks U.S. Open commercial format again

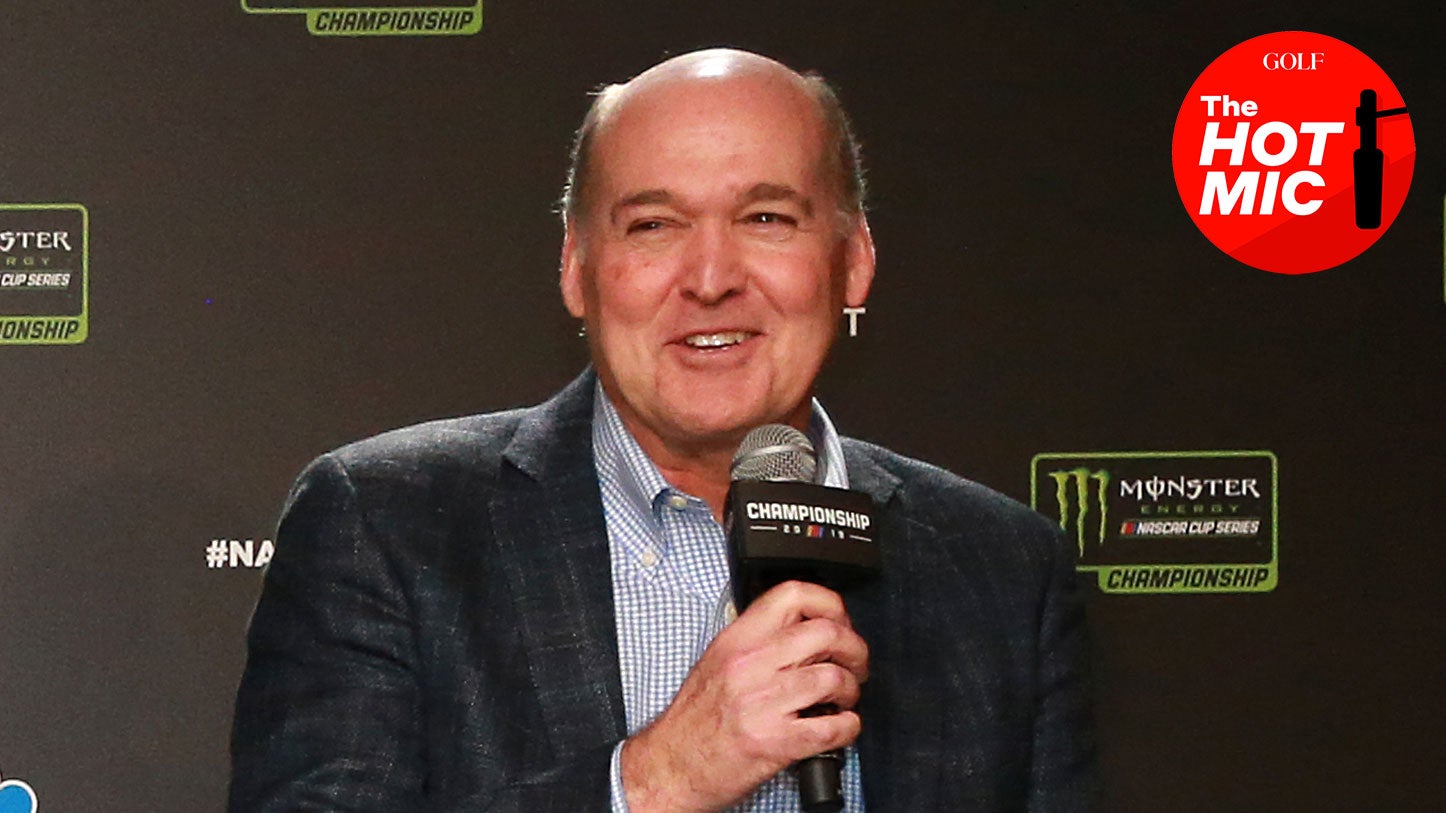

NBC Sports EP Sam Flood said NBC would tweak the commercial format for the U.S. Open again in 2024, reducing the number of interruptions.

The post Looking for ‘solutions’, NBC tweaks U.S. Open commercial format again appeared first on Golf.

NBC Sports EP Sam Flood said NBC would tweak the commercial format for the U.S. Open again in 2024, reducing the number of interruptions.

The post Looking for ‘solutions’, NBC tweaks U.S. Open commercial format again appeared first on Golf.

NBC Sports executive producer Sam Flood knew the questions were coming.

“One topic that always comes up around major events is the flow of our shows,” Flood said unprompted during his opening statement on Thursday’s U.S. Open media call. “And obviously, unlike the NFL, the NBA, Major League Baseball, there are no natural breaks in the action or golf tournament…”

He hadn’t said the words exactly, but everyone on the call knew exactly where he was headed. Flood was about to address the elephant in the room: Golf’s TV commercial overload.

“We hear the comments and we know that we need to look for solutions,” he said. “We’re working with our partners and figuring out ways to make sure as much golf as possible is going to be shown.”

Flood’s words did not ring as a surprise to anyone on the call, but his decision to say them did. For the first time in his tenure as the head of NBC’s golf product, Flood acknowledged the growing sentiment among golf fans that NBC’s TV product has become inundated with interruptions. And for the first time, he admitted he’d like to solve the issue.

Now came the hard part: The plan.

***

Until the emergence of LIV Golf, TV commercials — specifically when and how often they were employed — were one of men’s professional golf’s biggest issues.

The explosion of the sports TV rights market turned golf into a multi-billion-dollar enterprise over the last two decades, but that financial growth has come with a hidden price: A steady flow of advertisements has invaded golf’s TV product, and the interruptions are only growing more onerous with time.

To understand the issue facing golf, you need only to understand rudimentary economics. The value of a television deal is directly tied to advertising revenue. (If advertisers are willing to spend $1 million to get their ads on a golf tournament telecast, then NBC will want to spend less than $1 million on the broadcast rights to justify putting it on the air.) Advertising revenue is tied directly to the size and perceived value of the audience. (Golf skews older and wealthier — theoretically, the people who would consume and ad and enact on it in some way — which is good news for networks.) In a healthy business environment, the supply and demand curves find equilibrium easily, allowing everyone to earn a reasonable profit. But every so often — like, when a new TV deal is signed worth way more than the previous one — the market resets. Suddenly losses can outpace gains, and a network has few options to make up the money: first, to raise the cost of each advertisement, and second, to sell more advertisements.

Now it should be noted that networks are not required to sign sports TV rights contracts worth standard deviations more than previous ones, nor are they required to sign a contract that requires increasing commercials to turn a profit. But if the deals are growing worse with time, why can’t the networks quit them? Well, because the networks have gotten hooked.

You see, the key to the whole sports TV business is scarcity. Today’s sports TV rights have gotten so expensive because live sports generate large, singularly focused audiences and robust advertising revenues better than anything else on television. As the entertainment landscape has grown increasingly fractured in the streaming era, much has been made about the “flood” of viewers leaving traditional cable. While many thought those developments would prove a death knell for sports on TV, the opposite has happened. Without traditional audiences on linear TV, it’s become nearly impossible to find similar audiences and ad revenues in other forms of content, which means that even if the ratings of sports broadcasts are lower, the scarcity of the sports TV audience has increased. And as scarcity increases, so does cost, even if that cost means stretching the limits of advertiser demand.

In the simplest possible terms, this is how professional golf wound up in today’s predicament: The money in the sports TV business is too good to for anyone on any side of the ledger to quit, but it’s getting harder to generate the advertising dollars needed to keep the whole thing afloat.

The USGA’s involvement in the predicament dates back to 2020, when the governing body sold its rights back to NBC (after FOX pulled out of broadcasting golf) for the reported sum of $38 million annually. In a world where the rights to a single NFL playoff game go for more than $100 million, $40 million for the second-biggest event in golf seems like a pittance, and in some ways it is. But for NBC, there’s an advertising squeeze — a need to sell enough spots in one weekend to cover the cost of the remainder of the USGA portfolio. Pressed between a rock (risking relationships with partners by raising the cost of each ad) and a hard place (selling more ads), NBC has chosen the hard place. (A third option — generating less profit from the USGA deal — has evidently not been explored.) Add in that the USGA’s TV contracts entitle it to a certain number of televised promotions alongside NBC’s own in-house ads, and suddenly NBC’s U.S. Open product feels more saturated with interruptions than even the most cluttered of PGA Tour’s telecasts.

It goes without saying that the situation is untenable in the long run, but as the USGA and NBC are entering a negotiating window for the next round of U.S. Open TV rights, it’s harder to figure out a solution that could see golf TV’s number of commercial interruptions drop. On one hand, it’s tough for NBC to justify a smaller profit-margin on its golf telecasts, particularly its big-ticket golf telecasts, at a time when Comcast chairman Brian Roberts has laser-focused on cash-positive businesses. On the other, it’s hard for the USGA to rally behind a smaller rights fee for the cost of its flagship event, particularly at a time when leagues like the NBA and NFL are seeing their rights fees increase tenfold in agreements with NBC.

And what happens if, as in 2013, NBC finds itself battling with another network for the USGA rights? Will scarcity push the pricetag even higher, perhaps increasing the number of ads shown during the U.S. Open?

***

In recent years, commmercial complaints have become a rite of passage for the U.S. Open telecast.

In 2022, ire around the telecast at Brookline grew so loud that newly enacted USGA commissioner Mike Whan took to Twitter to address fan concerns directly. And in 2023, Whan dedicated a segment of his annual USGA state-of-the-state press conference to addressing the governing body’s efforts at limiting commercials at LACC, claiming the network had managed to cut weekend interruptions by more than 30 percent — or 19 fewer interruptions from the year before.

“I’m proud of NBC,” Whan said. “They’ve really cut back on some of their in-broadcast programming. So have we at a similar level. They’ve got bills to pay and so do we, so I get that.”

“There will still be millions of people that don’t like the commercial interruptions because no matter how low you get it you’ll get that feedback,” Whan said. “But yeah, we made an effort between both of us.”

The commercial changes were felt somewhat during the weekend at LACC last June, but many viewers still took issue with the number of interruptions throughout the tournament coverage. At a media day event in Pinehurst last month, NBC and USGA officials indicated they weren’t fully satisfied either, saying they went back to the drawing board again during the golf offseason to see how to improve the product even further. All of that brought us to Thursday morning, when Flood addressed the press as part of NBC’s U.S. Open media call for the first time, fresh off the network announcing some 300 hours of live coverage across a handful of networks for the week at Pinehurst No. 2.

So what’s the plan to fix the U.S. Open telecast? For now, Flood says, it’s a band-aid.

“We do have to pay [for golf TV rights], so we do have to work through these partnerships to make all this happen,” Flood said. “But we have found ways to reduce interruptions and we’ve reallocated the resources within our broadcast.”

For the time being, Flood says the network has focused its energy on improving the processes that go into golf on television, ensuring the transitions are clean and fluff is minimal. At the U.S. Open, Flood is hopeful there will be some noticeable downstream effects of those tweaks.

“For example, Thursday, we’re gonna have two additional minutes golf per hour than in past years,” Flood said. “And then you add to that our new readerboard system, which our math has told us will get five more shots an hour. We’re able to stay on the line of golf and not go away from the action.”

But bigger, more meaningful discussions about the structural setup of the USGA telecasts will have to wait until it comes time again to craft another rights deal.

“There are different ways we feel we can engage the audience and build the content. We have reduced the amount of promo time in the shows and reduced the amount of time we’ll be [away from the action] by really smartly evaluating everything we do, where it hits and how it’s integrated into the telecast,” Flood said. “We feel really good about how we’ve revamped the execution.”

Revamped is a word that should give golf fans some hope, especially considering that NBC Sports’ lead golf voice is the one delivering it. But is NBC’s product a revamp away from delivering the kind of coverage golf fans yearn for, or is a more considerable reshaping of golf on TV needed to deliver to those ends? And how would the network approach some of the costlier measures that could come with it?

These are the questions NBC faces through the rest of a turbulent 2024 — questions its leader, Sam Flood, certainly knows are coming.

Soon enough, we’ll learn if he has the answers.

The post Looking for ‘solutions’, NBC tweaks U.S. Open commercial format again appeared first on Golf.